Steel exports in 2023 "strong" Can 2024 continue?

Has the current global steel production, price, and demand changed? First of all, from the production point of view, overseas steel supply is in a continuous recovery trend. According to the World Steel Association data show that in November, the world's 71 countries and regions included in the world Steel Association statistics of crude steel production was 145.5 million tons, an increase of 3.3%. Among them, India's crude steel production was 11.7 million tons, an increase of 11.4%; Crude steel production in Russia and other CIS countries + Ukraine was 7.4 million tons, up 14.8% year on year; Turkey's crude steel production was 3 million tons, up 25.4% year on year. With the obvious recovery of overseas steel production, this will have a certain impact on domestic steel exports.

In terms of price, the current export price advantage of China's steel is still relatively strong, which has formed a certain support for steel exports. Lange Steel Research Center monitoring data show that as of January 4, 2024, India, Turkey, CIS hot rolled coil export quotation (FOB) were 635 US dollars/ton, 705 US dollars/ton and 610 US dollars/ton, China hot rolled coil export quotation (FOB) was 575 US dollars/ton; At present, China's hot coil export quotation is lower than India, Turkey, CIS hot coil export quotation of $60 / ton, $130 / ton and $35 / ton, respectively.

From the demand side, the global economy is now in the process of recovery. According to the data of the China Federation of Logistics and Purchasing, the global manufacturing purchasing managers index (PMI) in November 2023 was 48%, a slight increase of 0.2 percentage points from the previous month, of which the European manufacturing PMI was 45.8%, an increase of 1.2 percentage points from the previous month, hitting a new high since the second half of last year; Asia's manufacturing PMI stood at 50.3 per cent, above 50 per cent for 11 consecutive months.

However, it is worth noting that the global manufacturing PMI has been running below 50% for 14 consecutive months, and at the same time, the export orders index of Chinese steel enterprises in November is still in the contraction range. This shows that the global economy is currently affected by factors such as geopolitical conflicts and trade frictions, and there are still some downward risks in the economy, and there is still some pressure on overseas demand.

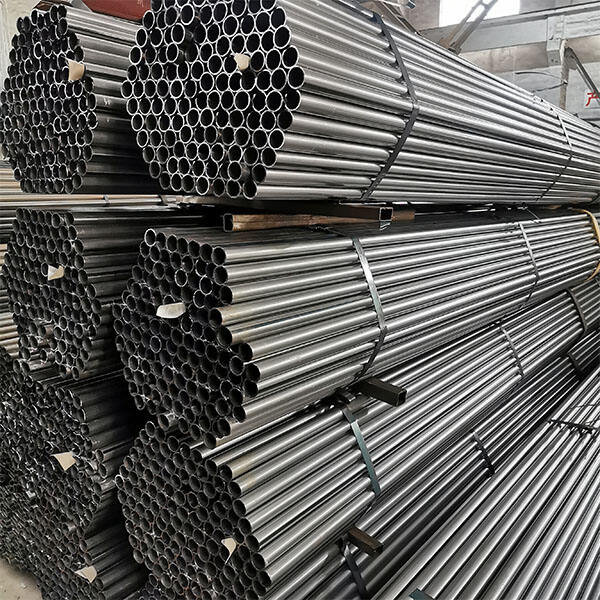

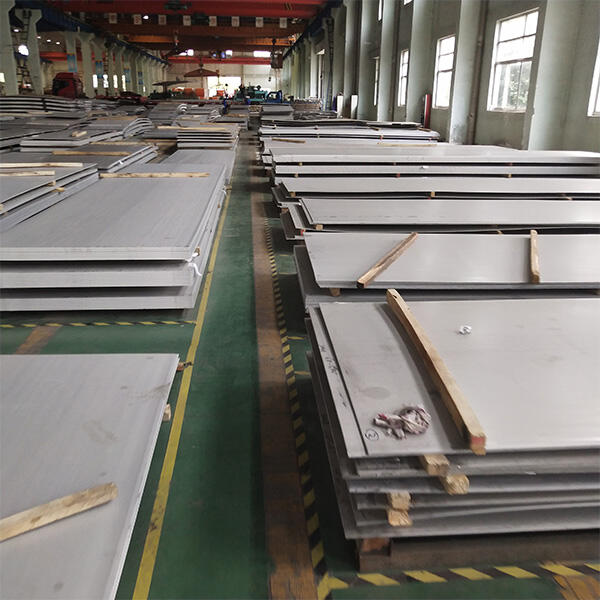

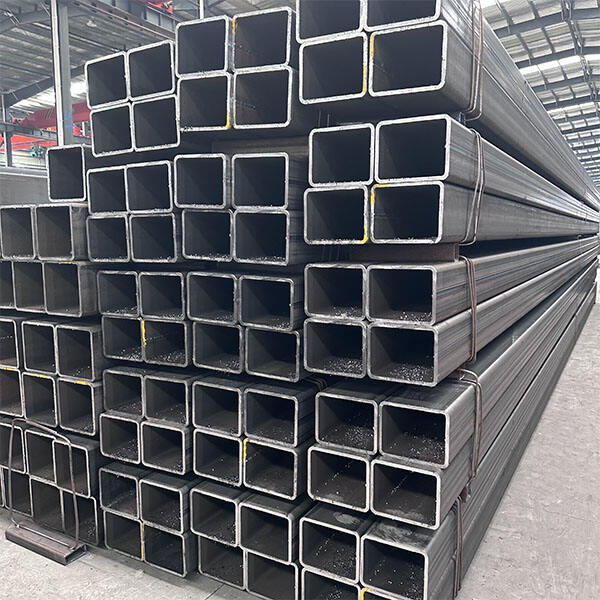

Recommended Products

Hot News

-

The weight of the first highest-strength thermoforming square pipe steel has been reduced by more than 6%, which has boosted the lightweight development of commercial vehicles

2023-12-27

-

This is the world's thinnest "hand-torn steel", the price is comparable to gold, the key is: made in China!

2023-12-27

-

New breakthroughs in the thickness of 304 and 316L stainless steel plates

2023-12-27

EN

EN

AR

AR

BG

BG

HR

HR

CS

CS

DA

DA

NL

NL

FI

FI

FR

FR

DE

DE

EL

EL

HI

HI

IT

IT

JA

JA

KO

KO

NO

NO

PL

PL

RO

RO

RU

RU

ES

ES

SV

SV

TL

TL

ID

ID

SR

SR

VI

VI

TH

TH

TR

TR

MS

MS

BN

BN

MY

MY

KK

KK